Getting a Southwest Companion Pass is an awesome bonus if you need to travel around the US. The Southwest Companion Pass allows you to fly one companion for free, whenever you fly Southwest.

This is an amazing deal, and I think a lot of my friends could benefit greatly from this deal, so I am going to detail how to get a Southwest Companion Pass here.

First off

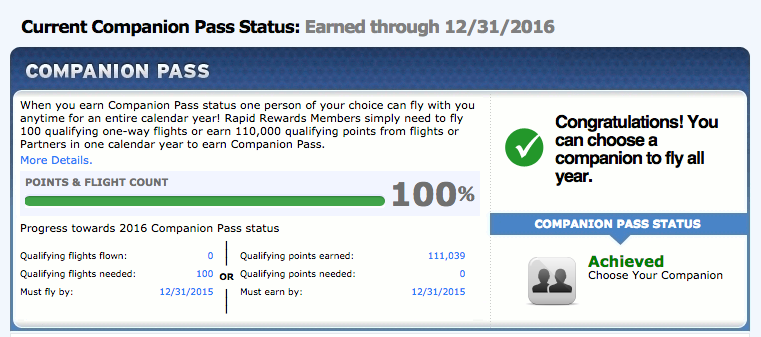

I’ve been known to do a lot of shady things, but I promise you this is not shady. I’ve been a Southwest Companion Pass holder for about 2 years now. It’s a real product offered by Southwest, not some sort of hack. There are also tons of people who have it. If you are learning about this for the first time, you are late to the party!

What you need

Let me start off by telling you exactly what you need so you understand the commitment you are making

- You have to signup for 2 Southwest Credit Cards (administered by Chase)

- You have to spend $10K dollars on those credit cards

- Each card has a $99 a year fee. So you are spending $200 in fees.

Before you get lightheaded and break out in sweats, give me a chance to explain why there is nothing risky or scary about this and how it’s pretty easy to do.

The Risks

It is commonly believed that having a lot of credit cards, and using credit cards is bad you for. This is simply not true.

I myself have 20+ credit cards, yet my credit score is ~800, which means my credit rating is probably better than 90% of Americans.

Credit card are only bad when you use them and you don’t pay them. So don’t do that.

But don’t take my word for it, do a quick google search and learn: http://bit.ly/1DYadiL

How the math works

Each Southwest Credit Card gives you 50K Southwest Rapid Rewards bonus points when you spend $2K in 3 months. To get a Companion Pass, you need to earn 110K Southwest Rapid Rewards points in the same calendar year. For every dollar you spend on your Southwest Credit Card, you get 1 Southwest Rapid Reward point.

Spend $2K in 3 months = 2K points

Get 50K bonus = 50K points

Total = 52k points

Now double it. If you get TWO Southwest Credit Cards, you get

52K x 2 = 104K

That means you still have to get 6K points (spend $6K) to get to 110K. The good thing is, you have all year to do that. Most people can spend $6K within 2-3 months.

How To

To ensure that this process goes smoothly, there are a couple of recommended steps that you SHOULD MUST follow.

- Open a Southwest Rapid Rewards account and get a Rapid Rewards number if you don’t already have one.

- Apply for TWO Southwest Rapid Rewards card AND use the same Rapid Rewards number from Step 1 for BOTH cards.

- Spend $2K on each card within 3 months. DO NOT screw this up.

- Spend $6K on either card before the end of the year.

The Two Credit Cards

I been talking a lot about “two credit cards”. Let me actually link to them now.

NOTE: You HAVE to use these links. These links are promotional links that gets you the 50K bonus. If you don’t use them, you won’t get the 50K bonus.

DOUBLE NOTE: These links may expire, so be sure to double check it.

Card #1

Southwest Chase Plus

Card #2

Southwest Chase Premier

Important Notes

- Apply for BOTH cards in one sitting. This reduces the number of credit inquiry on your credit report. It will also ensures that you get both cards. It would be a nightmare if you got one card today, and tomorrow they no longer offer the 50K bonus. Then you have no way to get the second 50K bonus.

- Do not forget to spend $2K on each card within the first 3 months. If you forget, you won’t get your bonus and that’s going to be a nightmare.

- After you get your 110K points, cancel both credit cards. You don’t want to keep paying the fees do you?

Is all this worth it?

F*ck Yes.

Southwest Rapid Rewards is amazingly easy to spend, and is a GREAT value.

At the end of this whole process, you will have 110K Rapid Rewards points. If you want to see how many trips you can get out of that, just go to the Southwest website and test it out. Choose “points” to see how many points it will cost.

On average, I would say 110K points is worth at least $2K in southwest flights.

But the greatest thing about Southwest Rapid Rewards point is that they make booking VERY easy. You can cancel your booking at any time and get a full refund of your points. You can also easily change flights right on their website without hassle. This is so much easier than using cash and buying non-refundable tickets. You honestly don’t understand how awesome this is until you used it a couple of times, so trust me.

Now remember, you now also have a Companion Pass, which means not only do you get great flexibility in picking FREE flights, you also get to bring someone with you for free with ZERO hassle. So all the benefits you received here are basically doubled (so $4K in southwest flights). The only caveat is that you only get to choose one companion for the lifetime of your pass, so pick wisely!

Also, if you earn the Companion Pass in 2015, you to keep it until 2016. So that’s a lot of traveling that can be had!

But Vinh, $10K is a lot to spend

Yes, but you also have a lot of time to spend it. You should get in to the habit of paying for EVERYTHING with your credit card — just remember to pay off your balance when you get your statement. Using cash is so lame… When you use credit cards, you earn rewards, all cash can give you is a disease.

Conclusion

Southwest is a great airline for traveling around the United States. They have a lot of flights to many destinations around the country. You just have to make sure you pick the right airport if you want nonstop flights. For example, in the bay area, OAK is a better airport for Southwest than SFO.

Anyways, that’s all there is to it. It is very easy to do and the benefits are amazing. So don’t be a sucker and continue paying cash for air flights!